The Santa Claus Rally market watchers were waiting for never came through and on Christmas Eve the S&P 500 entered bear market territory. This means that there has been a 20% decline from its previous all-time high less than three months before. Here are five thoughts for you as you reflect on your investments right now.

- It’s natural to feel fear. Investor emotions are a natural part of your journey and it wouldn’t be appropriate for me to tell you not to feel fear. Just as fear is a natural reaction, it’s helpful to acknowledge that for most people, down markets feel twice as bad in terms of volume or magnitude relative to positive or up-markets. It’s also helpful to reflect on your previous experiences in declining markets. Refer to your financial plan and investment policy which, if properly prepared by a financial planner, include up and down markets and a strategy for investing through market bounces.

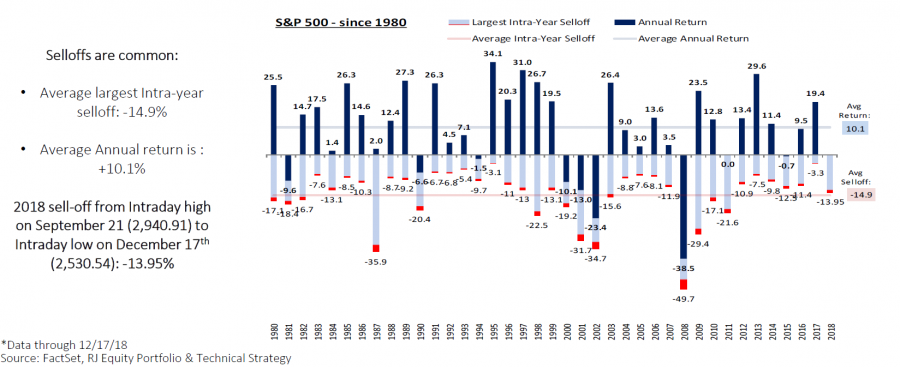

- This sell-off is larger than the average annual pullback, but not by much. Raymond James research points out that the average annual sell-off is an almost 15% decline, yet average annual returns for equities are more than 10%. Fluctuations are an unfortunate but also necessary part of a successful investor’s journey.

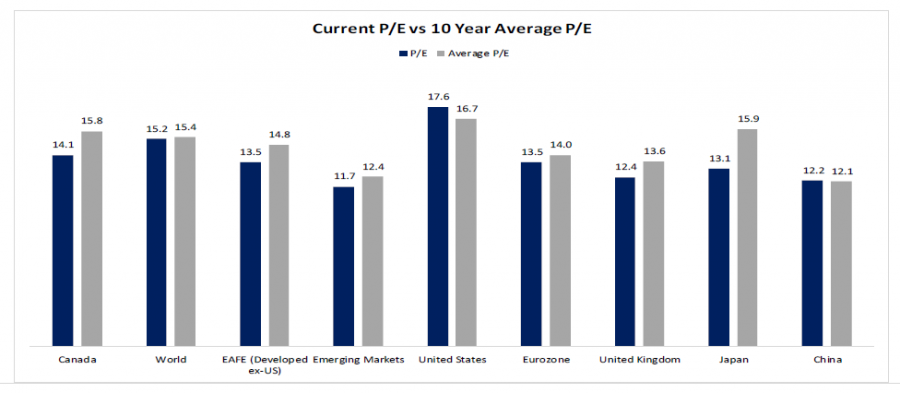

- Keeping an eye on trends. Growth stock returns have dominated value returns in recent years and US stock performance has exceeded lackluster international performance. Bonds have had little or no real yield for years. Today, some of those trends may be shifting. See details on valuations around the world [SOURCE: Source: MSCI, FactSet, RJ Equity Portfolio & Technical Strategy].

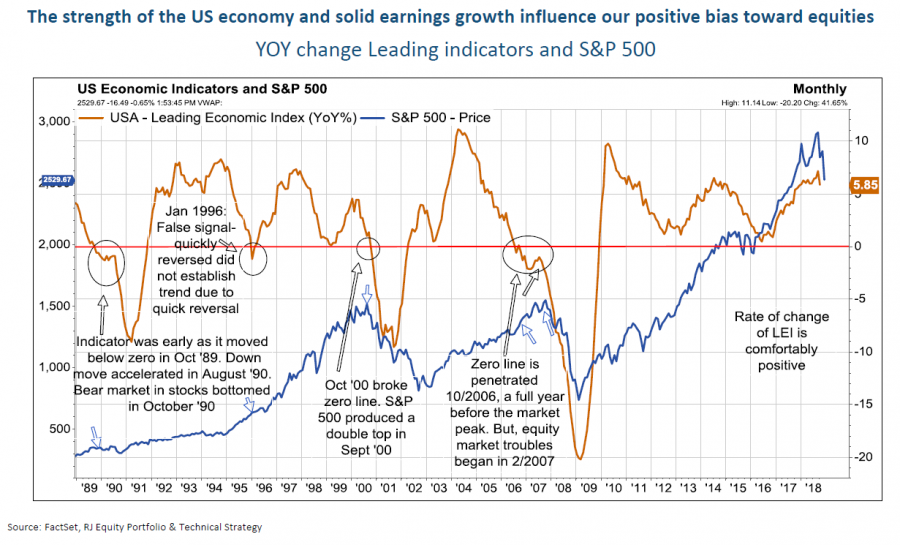

- Economic numbers are still positive. 2018 was a good year for earnings growth. CNBC reported that retailers had their best year in six years this holiday season. Unemployment remains low and going lower. All of this could be muted with a prolonged government shutdown, but if politicians can agree to cooperate in early January, we don’t believe this should not have a significant impact on economic trends. See the overall economic indicators below.

- The Market’s numbers are much bigger. I still think about the returns of the market day-to-day by the Dow’s numbers. They’re the numbers we heard throughout time, and while longer term returns of large US stocks are often best measured by the S&P, the Dow’s points are a daily point of reference. On December 26th, the Dow was up more than 1,000 points, a first. LPL market strategist Ryan Detrick noted on Twitter yesterday that it took the Dow 76 years of history to close above 1,000 points (from 1896 to 1972). Wednesday the market gained 1,000 points in 6.5 hours of trading. All of this is a testament to the power of the stock market over time, not its inherent weaknesses.

Through the market turbulence, those of you I have the fortune to work with have companions on your investment journey – your financial plan and your financial planner. Don’t stew on market turmoil alone – the team here at Pearl Planning is here for you. Our office is open for the remainder of the year. Don’t hesitate to reach out to continue the conversation.

Required disclosures: The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. One cannot invest directly in an index. Any opinions are those of Melissa Joy and not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation.

Melissa Joy, CFP®, CDFA® is President and Wealth Advisor at Pearl Planning. Reach out for a call today at 734.274.6744.

Our 10 Perspectives on Giving

Our 10 Perspectives on Giving