You have questions. We have answers.

It’s hard to know what to do next in your finances.

Our firm can answer questions like these for clients and more, daily.

What do I do with my extra cash?

Can I retire early?

How do I lower my taxes?

Can I change careers?

What am I overlooking?

What does my retirement income look like?

Which financial goal should I tackle first?

Who May Need A Financial Planner

While plenty of people can manage their money themselves, some should consider professional help when their finances become more complex.

If any of the following apply to you, you may have outgrown your current advisor or a DIY approach. You are…

A high-income earner who wants to minimize taxes

Working in a job with complex stock options or benefit packages

A parent who wants to make smart financial choices for your family

Maxing out obvious retirement accounts & want to know what’s next

Looking for a second set of eyes on your investments

Interested in modeling out the impact of different financial decisions

Expecting a large influx of assets or a sizeable inheritance

Preparing to sell a business or make a big financial move

Planning to retire soon and want to confirm you have saved enough

Concerned you may not have enough insurance to protect yourself

Managing a complex life or career and need help making decisions

Struggling to balance multiple financial goals & need to prioritize

If you see your financial goals on this list above, or your current advisor is not helping you with robust financial planning, schedule a complimentary call with our friendly team.

Even if we are not a great fit to work together, you’ll leave the call with a few actionable tips for your finances from a CERTIFIED FINANCIAL PLANNER®.

Why it matters to hire a

CERTIFIED FINANCIAL PLANNER®

In financial planning, it can be hard to know who you can trust. Credentials and experience matter. This is why you want to hire a CERTIFIED FINANCIAL PLANNER®, also known as a CFP®.

What Makes Us Different

Small Firm, Big Heart

You get access to advisors who worked at big advisory companies, but in a small firm environment.

We Get You

Our clients have busy lives and complex careers. We try to take tasks off your plate so your to-do list shrinks when you work with us.

Female-Led Advice

While our firm works with men and women, we know money is emotional. With Pearl Planning, you get judgment-free, kind, and clear advice.

Independent

We are independent fiduciaries.

No one tells us what to buy or sell to you.

News & Resources

Money talks,

are you listening?

Do you want a preview of what it is like to work with Pearl Planning?

Tune into our popular podcast Women’s Money Wisdom.

Hundreds of episodes, ready to answer your biggest financial questions in a jargon-free way.

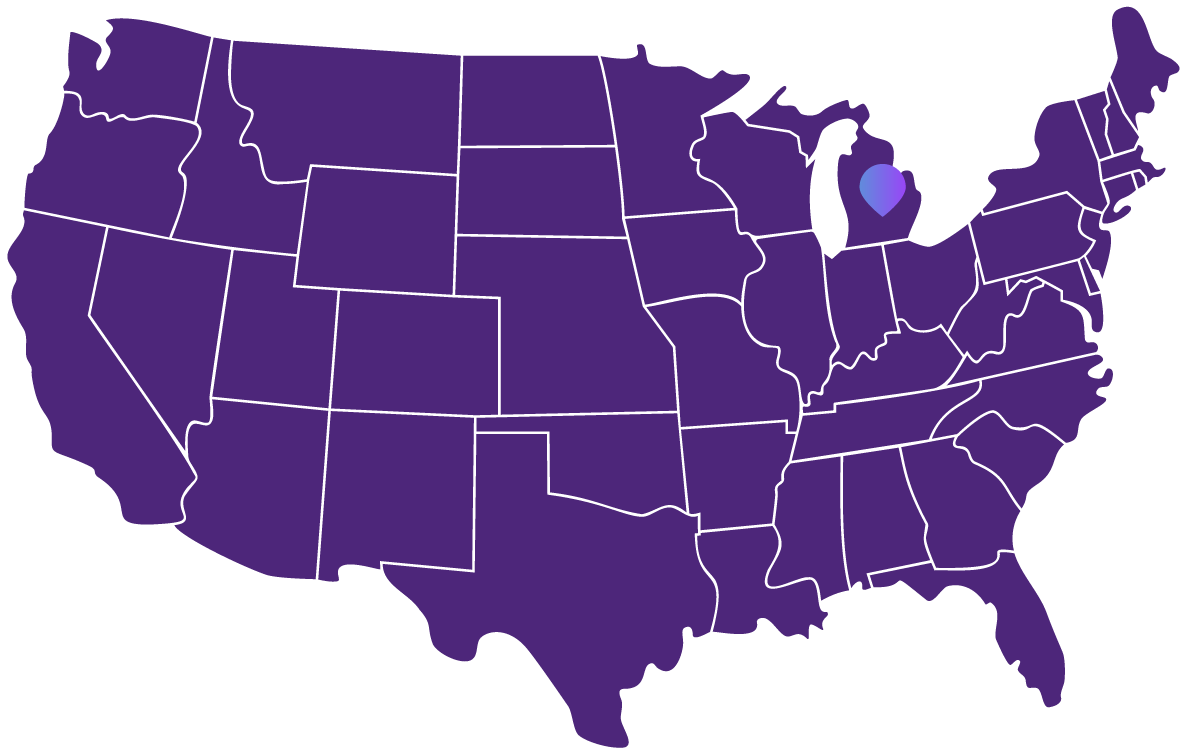

Financial Planning in

Dexter, Michigan & Nationwide

While our in-person office is in Michigan, our team works with clients locally in Michigan and virtually across many states in the country1.

As long as you have a strong wifi signal, Pearl can help you manage your finances and investments.

1As of March 11, 2024 Pearl Planning has clients in 26 states, in the USA.