In previous posts, we have discussed Roth conversions being a potential option when you have phased out of the contribution limits for a Roth IRA. Today, we will be discussing another type of Roth conversion called a mega backdoor Roth contribution.

A mega backdoor Roth IRA involves making a non-Roth, after-tax contribution to a 401(k) and then rolling it out of the 401(k) into a Roth IRA. Under the right circumstances, this can potentially allow you to contribute tens of thousands of dollars into your Roth IRA. It is important to note, that the rules are very restrictive and limiting for the allowance of mega backdoor Roth contributions. It is crucial to coordinate with your tax accountant, as well as your financial advisor to determine if this is an option that makes sense for you.

You should begin your analysis by determining if you have made a maximum salary deferral contribution of $19.500 (or $26,000 if you are 50 or over) to your employer plan. If not, it is recommended that you begin by maxing out these contributions prior to moving forward with a mega backdoor Roth contribution.

If you have maxed out your 401(k) contributions, the next step is to determine if your 401(k) allows you to make non-Roth, after-tax contributions. Check out your Summary Plan Description for your 401(k) for details on your plan allowances. If your plan does not allow you to make non-Roth after-tax contributions, unfortunately, you are not able to make mega backdoor Roth IRA contributions.

Actual Contribution Percentage Test

If you determine that you can make non-Roth after-tax contributions, the next step is to verify if there is an opportunity under the Actual Contribution Percentage (ACP) test for you to make additional contributions. This test must be conducted to ensure that 401(k) plans don’t unfairly favor higher-income employees. Check with your plan sponsor for more information on the ACP test.

How Much Can I Contribute?

Once you have confirmed that there is room for additional contributions under the ACP test, you must calculate the sum of all your contributions made this year. If your contributions are less than $58,000, you are typically permitted to make a mega backdoor Roth IRA contribution. The amount you can contribute equals $58,000 minus all employer and employee contributions. This amount excludes any catch ups.

Plan Specific Matters to Consider

Determine if your 401(k) plan allows for in-plan Roth conversions. If so, you can convert your non-Roth, after-tax contributions, but you must also convert any earnings. If you are not allowed to complete in-plan Roth conversions, check to see if your 401(k) plan allows for in-service, non-hardship, distributions. If this is also not allowed, you must wait until you leave your employer to roll over your account.

If your plan does allow for in-service, non-hardship distributions, next determine if the 401(k) plan maintains separate subaccounts for pre-tax and after-tax contributions. This feature will allow you to roll over your after-tax sub-account and manage the pre-tax sub-account separately. Furthermore, if timed properly you can minimize the earnings that accrue in the after-tax subaccount and move the funds into your Roth IRA for tax-free growth and distributions.

Either way, all distributions from your account must be funded proportionately with pre-tax and after-tax dollars in order to abide by the Pro Rata Rule.

You can also roll the non-Roth, after-tax contributions to a Roth IRA. Keep in mind that all pre-tax contributions and all earnings including those on non-Roth, after-tax contributions are taxable. However, they can and should be rolled to a Traditional IRA to delay a taxable event.

It is important to note that Roth conversions, of any kind, are allowed to be completed once per year.

Although there are many hoops to jump to ensure that you are eligible to make a mega backdoor Roth IRA contribution, your diligence can pay off. Although not appropriate for all investors, mega backdoor Roth IRA contributions in some specific cases can be a planning technique that helps accomplish both financial and tax planning goals.

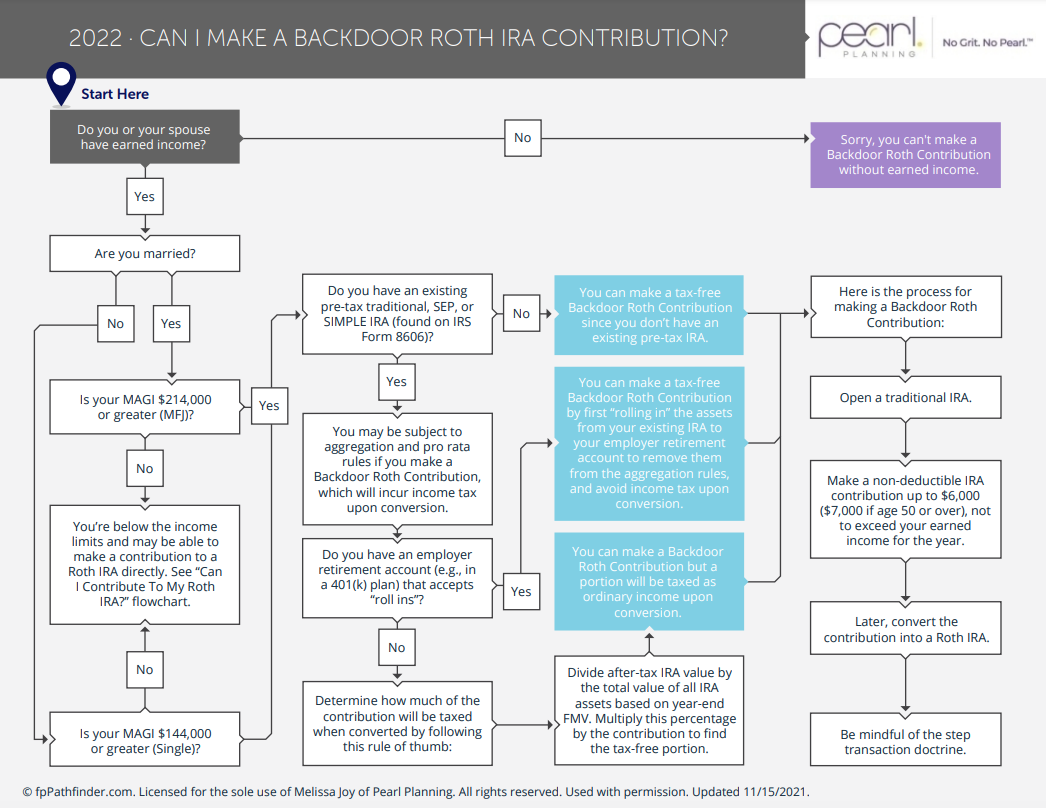

To help make your analysis easier, check out the flowchart below. It addresses some of the most common issues that arise for a client trying to make a mega backdoor Roth IRA contribution.

If you would like to talk about how mega backdoor Roth IRA contributions may fit into your personal financial situation, please reach out to the Pearl Planning team to schedule a time to discuss.