With inflation soaring, the popularity of a little-known treasury program for small investors, Series I Savings Bonds, is coming into focus. The I Bond is linked to an interest rate plus inflation. Limited by the amount you can buy, there are several factors to consider before making a decision to buy. I recently bought an individual I-Bond to help you understand the process and evaluate whether it makes sense for you.

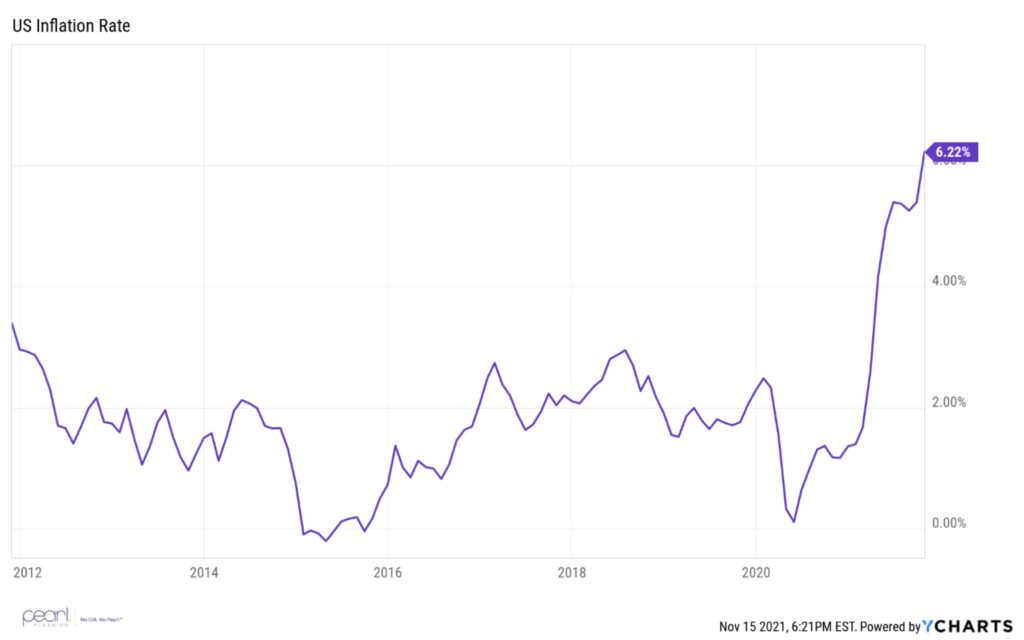

US Inflation Skyrockets

US inflation rates, low for the last decade, have had a major surge recently as a result of a variety of factors including government stimulus, supply chain issues, and a tight labor market. The most recent measure of US inflation was 6.22% annualized, well above any rate of inflation recorded in the last 10 years.

Inflation Protected Bonds

Treasury Inflation-Protected Bonds (TIPS)

One source of protection against inflation is inflation protected bonds. Sometimes called TIPS, Treasury Inflation Protected Bonds are long bonds issued by the US federal government. Seems like a simple solution, but the broader market has caught on to the popularity of TIPs. Because interest rates are extremely low and these bonds are quite popular, the price of the bonds can be quite high. This high price may eat away at the inflation-fighting power of the bond and the potential total return as inflation rises.

Corporate Inflation-Protected Bonds

Companies can also issue inflation protected bonds. The challenge is these have the same pricing issues and are issued less often by companies, especially given where inflation is at today.

Treasury Direct I Bonds

Since 1998, the US Treasury has offered an “I Bond” program direct to consumers. The program is limited in terms of the quantity of bonds that you can buy and has several distinguishing features. You can learn full details at the Treasury Direct website.

Key I Bond Characteristics

You should first familiarize yourself with I Bond characteristics before you decide whether you should buy them. Here are five key characteristics:

- How is interest calculated? I Bonds are a combination of an interest rate component as well as an inflation component. The current interest rate component is zero percent. That’s right – 0%. But the current annualized inflation component is 7.12%.

- How often do rates change? I bond rates are calculated in six month increments November through April and May through October. So, the 7.12% interest rate will be effective for a monthly payment through April this year. Then, the inflation calculation will be reset to the current inflation rate at that time.

- How much can I buy? I Bonds have a small minimum purchase – as low as $25. The maximum purchase, though, is limited to $10,000 for electronic purchases and/or $5,000 for paper purchases. These limits apply each calendar year. I consider this one of the major drawbacks of widespread use of I Bonds because it requires extra management and administration for a relatively limited amount of funds.

- When can you sell I Bonds? I bonds can be sold for their original purchase price plus interest earned after 12 months of ownership. During the first 5 years of ownership, early redemption results in a penalty of 3 months of interest.

- Can I gift I Bonds? Yes! In fact, I bonds can make a good gift, especially right now. As an added bonus, the purchase amount counts toward the recipient’s I Bond limit, not the purchaser’s limit.

Should I Buy I Bonds?

Keep these things in mind as you consider I Bonds.

Are you ready to manage another account?

Over the years, many clients have had Treasury Direct accounts whether they were a gift from a grandmother or a spontaneous decision at one time or another. I Bonds need to be managed and tracked so you don’t lose context for them. You may want to own them long-term, but there have been many periods of time where money markets or other short-term financial instruments offered a more attractive or flexible return. So, ask yourself if you’re up for managing a small account at a new or additional place (Treasury Direct). I am hesitant to recommend paper bonds as there is an added layer of management and tracking that can feel decidedly ancient in today’s day and age.

Are you aware that inflation rates can change or even be negative?

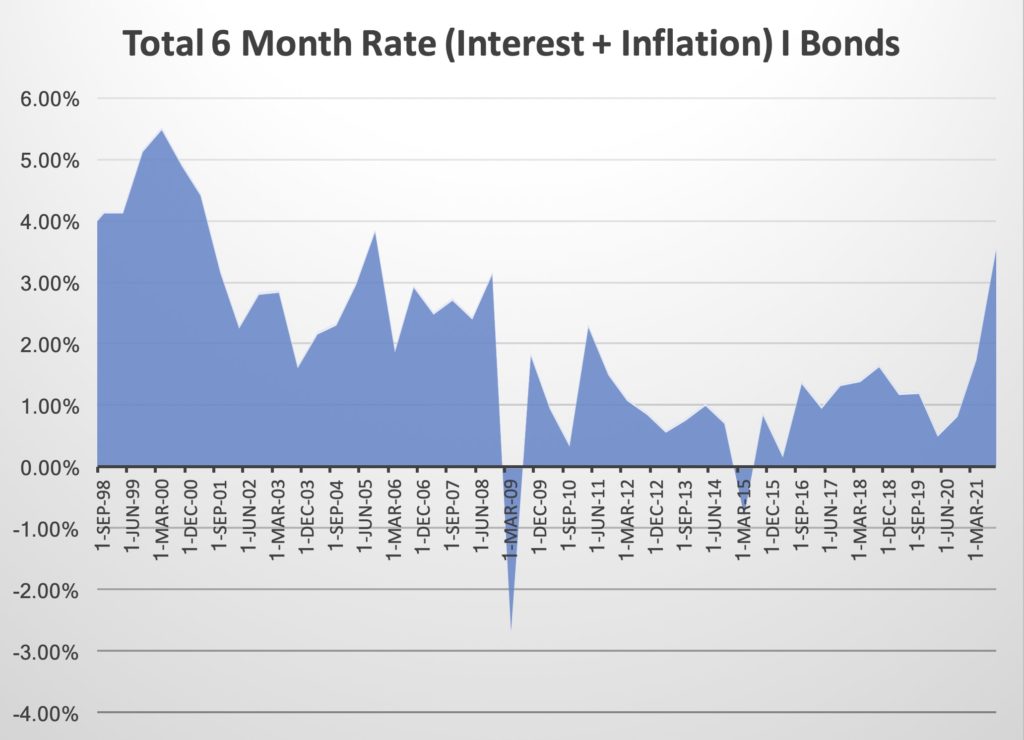

You are not assured a positive inflation rate which can really hurt, especially when the interest rate component is zero percent. In 2009, the inflation rate dipped into negative territory resulting in zero percent return for these bonds. Here’s a look at the combined inflation and interest rate component over time.

Source: Treasury Direct

You may look at this chart and think investing in I Bonds would have been an easy decision in the late 90’s when the 6-month rate exceeded 4%. Keep in mind that at that time, interest rates were much higher. You’ll need to be able to compare the bonds to inflation as well as the overall interest rate environment. Today’s interest rate environment is extremely low which is worth noting when considering an I Bond purchase. [NOTE: When yields were negative, the bonds paid zero percent.] Find the full chart of I Bond interest rates and inflation rates plus the composite interest rate or yield.

Do the I Bonds match your investment needs?

High net worth investors or those of you who hold a significant cash position may find that the limitations reduce the value of the I Bond opportunity. Take the limits into consideration, but also remember you may be able to maximize a purchase when buying for multiple members of a household like spouses.

I Bonds do offer a considerable amount of safety for investors with their US government issuance. This would be noteworthy for cautious or conservative investors.

Another consideration is the required holding period for an I Bond. Very short-term money would likely not meet the 12-month minimum for an investor and a 3-month yield penalty is not ideal in all but they lowest return period.

For gifts to family members, I encourage you to consider that this is a gift, not something you can still control. So, a gift to a minor would be theirs to use at the age of majority.

How Do I Buy I Bonds?

- Establish an account at Treasury Direct (gov). I hesitate to recommend the paper purchase of I Bonds due to the concerns listed above for tracking and management. Enter your account registration information.

- Link an electronic account you wish to use to fund your purchase.

- Go through verification process with e-mails confirming your identity and e-mail address.

- Make your purchase.

- Repeat steps with other family members and/or make plans to make additional purchases in the next calendar year.

- Update your financial records and/or notify your financial planner.

- Make sure that your I Bond account is titled in a way that would address any estate planning needs, especially during a pandemic. Consider titling assets in a trust or updating the registration to include a beneficiary form and make sure that you note the existence of the account with your financial planner or other financial housekeeping documents.

In my case, I decided to buy $10,000 I Bonds with long-term emergency reserves. Because I’ve gone through the trouble of the process once, I’ll likely repeat the same process with my spouse for a total of $20,000 purchased in 2021. Then, we will repeat these steps in early 2022 for a total of $40,000 between the calendar years. I am making a note to check on the yield and inflation environment in November 2022 to ensure that I don’t leave these assets untended if circumstances change as market conditions are constantly evolving.

Need to discuss your particular personal financial situation and how Series I Savings Bonds or other investment strategies may fit with your investing needs? Reach out to the Pearl Planning team to schedule a time to discuss.