On July 4, 2025, President Donald Trump signed new policy and tax legislation named “One Big Beautiful Bill Act” (OBBB) into law. This bill included long-term tax policy as well as budget commitments and spending cuts that will be phased in (and in some cases out) over multiple years.

This is an 800-page bill and I’m writing based on articles and summaries provided in the first days after the bill became law. It is likely that clarification and planning considerations will reveal themselves over time, and this summary was created to the best of my knowledge in the early days.

Here’s a summary of what we know about the new legislation. (Sources: X.com @CPAPlanner, USAFacts.org, Wikipedia,

Permanent Tax Brackets

In 2017, during President Trump’s first term, the Tax Cuts and Jobs Act (TCJA) detailed new tax brackets linked to inflation with a slated expiration date of December 31, 2025. This was likely timed to coincide with the end of Trump’s second term if he had been reelected after his first term.

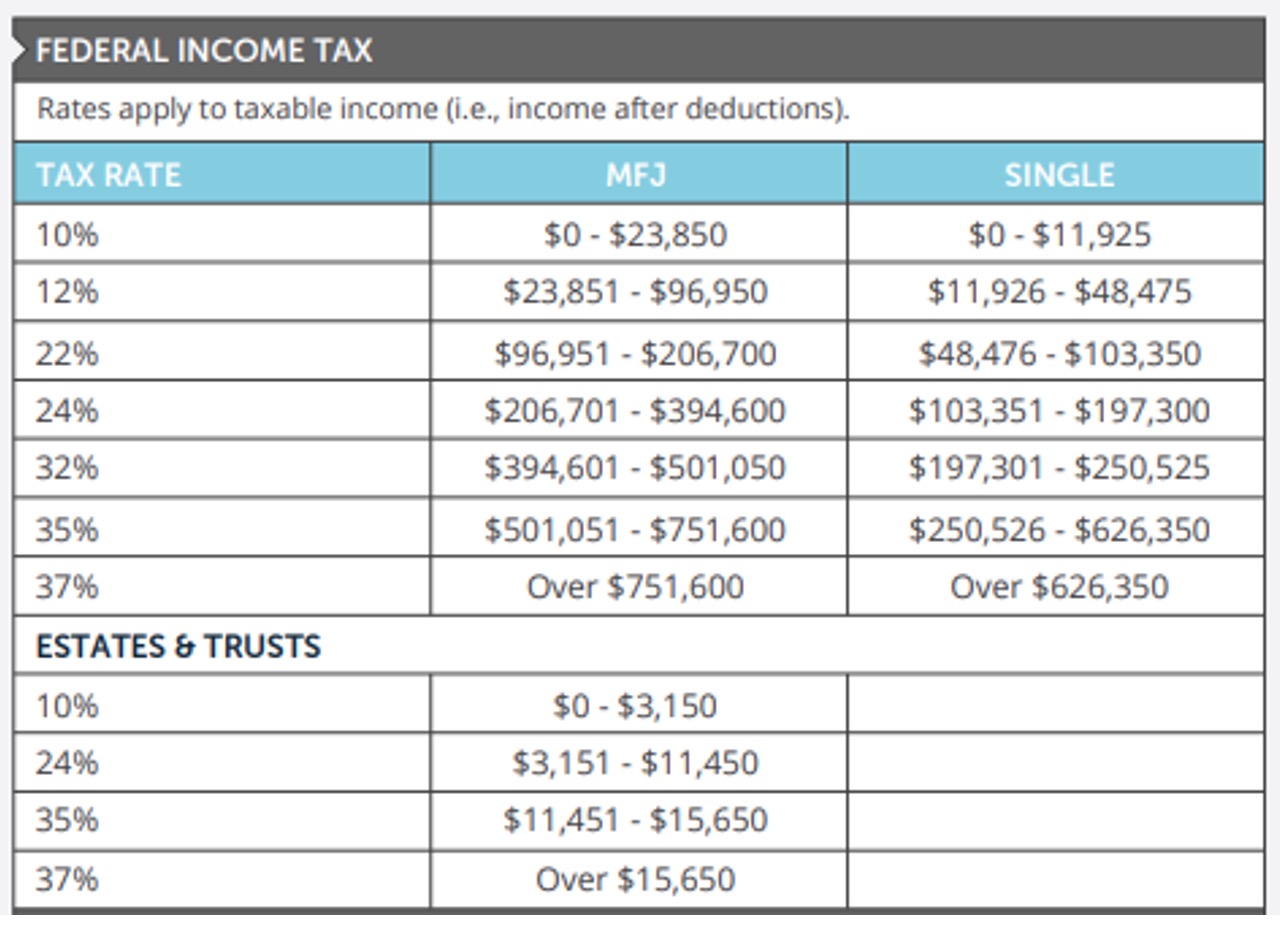

The OBBB makes the tax brackets created by the 2017 legislation permanent with inflation adjustments. Here’s a look at how these tax brackets work in 2025. In 2026, there will be an inflation adjustment making the income ranges slightly higher, and so on.

Standard Deductions

TCJA issued a much higher standard deduction in exchange for repealing personal exemptions. This becomes permanent with a little higher sweetener. This year’s standard deduction will be as follows:

- $31,500 for Married Filing Jointly, up from $30,000 previously for 2025

- $15,750 for Single, up from $15,000

- $23,625 for Head of Household, up from $22,500

New Deduction for Seniors

While not repealing taxes on Social Security, the law incorporates a new deduction for people who are 65+ which is being touted as an elimination for taxes for Social Security. For many Social Security recipients, this law will result in lower taxes for nearly 90% of seniors receiving Social Security. Notably, about two-thirds of seniors currently received their Social Security income tax free. But, if you are receiving Social Security and also have adjustable gross income that’s higher than $150,000 for Married Filing Jointly and $75,000 if single, you’re still going to need to pay tax on at least some 85% of your Social Security. The bill fully phases out at $250,000 MFJ income, $125,000 for others. This deduction will be valid for 2025 through 2028.

Considerations for Minors

Child Tax Credit

The Child Tax Credit is getting a modest bump – was $2,000 per child and is now $2,200. This lucrative credit, which includes high phaseouts above $400,000 MFJ or $200,000 single, is fully phased out at $444,000/$244,000. Starting in 2026, the child tax credit will be indexed for inflation and keep in mind that it is a per child basis for kids under 17 at the end of the tax year.

The Trump Account

This bill created a new account for minors. Contributions can be made up to $5,000 per year and distributions will be taxable like an IRA account. For children born between 2025 and 2028, the federal government will kick in $1,000 per child as a pilot program for these accounts. If you have an infant today, you’ll have to wait till next year (one year after the bill passed) to find out exactly how these accounts work. More to come on these!

Itemized Deductions & Miscellaneous TCJA Items Made Permanent

Certain deduction rules introduced by the TCJA were also made permanent. The Tax Cuts & Jobs Act which combined higher standard deductions so fewer and fewer people itemized—prior to 2018, 31% of returns itemized compared to 9% the following year! (Source: Tax Policy Center)

- The Pease limit which reduced eligible deductions for high earners was permanently eliminated. It had been scheduled to come back at the end of the year.

- Miscellaneous itemized deductions which included deductions for unreimbursed employee expenses, tax preparation fees, investment fees and expenses, and some other fees are also not going to return. Personal exemption deductions were also permanently eliminated after being temporarily eliminated earlier.

- The cap on mortgage interest deductions was made permanent at $750,000 although now mortgage insurance premiums can also count. Note – there has been no inflation adjustment on this amount since it’s original limitation for the 2018 tax year. Based on CPI, the 2018 $750,000 would be $959,700 if the limit had kept up with inflation, and certainly home prices have, indeed, gotten higher.

- For those who itemize with charitable gifts, there will be a reduction in the amount you can deduct by 0.5% of adjusted gross income. But the 60% cash AGI limit was made permanent.

State & Local Tax Deductions (SALT)

This itemized deduction was severely capped to $10,000 MFJ and single in 2018 and has been a major source of policy debate ever since. Now the cap is $40,000, but it has income limitations! Note that this is indexed, but not to full inflation. Instead, it will rise 1% per year, as well as the income limits listed below.

The phaseout is between $500,000 and $600,000 of adjustable gross income for married filing jointly and single filers. Note that if you’re married filing separately, the limitation phases out at $250,000. Focusing on this $500,000 to $600,000 range may become very important to taxpayers if close and able to stay under. This will be in effect for 2025, but this deduction cap will only be effective through 2029, and then will sunset back to the $10,000 limit.

New Separate Deductions (Tips, Overtime, Charitable Gifts, and Car Loans)

No Tax on Tips

There now won’t be income taxes on tip income via a new deduction. No, you can’t make all of your income a “tip”, there are limitations to what a tip is and there is, indeed, a definition for qualified tips. The maximum tip deduction is $25,000 and this phases out at $300,000/$150,000 of adjusted gross income. This will be sunsetted in 2028.

No Tax on Overtime

President Trump partially fulfilled a campaign promise by limiting the income tax on overtime via a deduction. The max deduction is $25,000 and, again, this phases out at the $300,000 adjusted gross income married filing joint or $150,000 for single filers and is fully phased out at income levels more than $550,000/$275,000. For this law, the “qualified overtime” is for people who would have traditionally been eligible for overtime. And, this part of the bill only stays in law through 2028.

Charitable Deductions If You Don’t Itemize

While the Tax Cuts and Jobs Act primarily eliminated the tax incentive for non-itemizers to give charitably, a small deduction is back in play. You can claim a $2,000 deduction if you’re a joint filer and $1,000 for everyone else. This is a permanent provision, but it won’t go into effect until 2026.

Car Loan Interest

If you’ve shopped for a car recently, you know it’s getting more and more expensive, especially if you’re borrowing at current interest rates. OBBB offers a new deduction for some people with car loans in certain income ranges. The rules are very specific. You can deduct a maximum of $10,000, but this phases out at $200,000/$100,000 MFJ/Single modified adjustable gross income. The phaseout goes through $250,000/$150,000. Loans would need to be initiated between 2025 and 2028, leases don’t count, only new cars get the deduction, and final assembly needs to occur within the US.

Clean Energy Credit Phaseouts

While Clean Energy Credits were available in a variety of formats primarily through 2032, most of the available credits will be phased out years earlier. Specifically (with phase out year) the Clean Electricity Investment Credit (shortened from 2032 to 2027), Clean Electricity Production Credit )from 2032 to 2027), Residential Clean Energy Credit (from 2032 to 2025), Energy Efficient Home Credit (from 2032 to 2025), New Energy Efficient Home Credit (from 2032 to 6/30/26), EV Purchase Credits (from 2032 to 9/30/2025), and EV Charging Station Credit (from 2032 to 6/30/26). Longer timelines remain for some nuclear and geothermal credits with primary impact on wind and solar.

High Net Worth & Very High Earner Considerations

Alternative Minimum Tax

The Alternative Minimum Tax is pesky, but will remain out of mind for most Americans making permanent changes introduced with the TCJA. But, the thresholds were reduced back to the 2018 legislation while having been previously linked to inflation. So married filers will be subject to more intrusive AMT at $1,000,000 for MFJ and $500,000 for singles (down from $1,252,700/$626,350 based on inflation indexing since 2018 if the law had not been passed for 2025).

Estate Taxes

When I started my career in 1998, the estate tax exemption was $625,000. Today, that exemption is rising from current law ($13.99 million) to an even $15 million with the new law effective starting in 2026. That’s for one person, so a married couple’s exemption is $30 million. This increase along with indexing for inflation is permanently law. While we know that laws are still subject to change (permanent just means no sunset), for those whose potential taxable estate falls into these ranges, the unified credit allows for gifts during lifetime to be transferred up to these amounts, as well.

Business Owner Considerations

Section 179 Deduction

Section 179 is a small business expensing cap that allows small business owners to immediately expense business equipment rather than depreciating over time. The caps for eligibility previously maxed out at $1 million and will now be $2.5 million. Phaseout will begin at $4 million of property (up from $2.5 million) and this is now a permanent deduction.

Bonus Depreciation

The Bonus Depreciation is often incorporated in conjunction with Section 179 for higher expenses, but was previously being phased out. The new law makes bonus depreciation permanent with no limit.

Qualified Small Business Stock (QSBS)

Qualified Small Business Stock is a special tax-preferential stock for small and growing businesses like start-ups intended to boost economic growth. Investors can avoid paying taxes on some or all of the stock when sold. For the new bill, eligible businesses are expanded to include gross assets up to $75 million from $50 million. The threshold is indexed for inflation. The maximum amount of gain that can be excluded is raised from $10 million to $15 million. There is a shorter potential holding period with phase-in starting at 3 year rather than a hard 5-year holding period. These expanded opportunity sets are available for stock issued after the bill became law on July 4, 2025.

Section 199A AKA Qualified Business Income

Qualified Business Income Deductions (QBI) are permanently extended and include inflation indexing. Keep in mind that caps on the deduction exclude many service providers with income in excess of $75,000 for single filers and $150,000 for joint filers. Meanwhile there is not a phaseout for non-service business.

Miscellaneous Additional Business Owner Considerations

- Small business owners will now have permanent incentive to provide family and medical leave with the Paid Family Leave Tax Credit providing credits for stand-alone insurance products as well as direct wages.

- Employers can permanently pay $5,250 (with indexing) toward employee student loans without including in income.

- Excess business loss limitations are made permanent.

- Pass Through Entity Owners (PTET) who work to maximize their SALT deductions through state workarounds will not be impacted with the legislation.

- Charitable giving and child care incentives for small employers are now permanent.

- Small business retirement plan start-up credits are increased and made permanent.

Additional Changes That Impact Your Money

This legislation is sweeping and will have additional economic, investment, and financial impacts. We will continue to expand and elaborate on these considerations as we have time.

- The Debt Ceiling was increased to $5 trillion. Current forecasts are for the debt ceiling at this level to be reached sometime in 2028. (Source: NYTimes)

- Medicaid and food stamps (SNAP) will require proof of work by the end of 2026 for most adults who do not have children under the age of 14. Able-bodied adults will be required to document 80 hours of work, volunteering, or training per month with twice annual certifications. General cuts to federal funding of health care are anticipated to have excess impact on rural health systems. For SNAP, work requirements are raised to include those between 55 and 65. Costs for food subsidization will be shared with states starting in 2028.

- 529s are expanded to include apprenticeships, tutoring, therapy for certain disabilities, some home schooling, and $15,000 student loan principal repayment per beneficiary.

- Changes to federal student loan plans include new repayment options, but Parent PLUS loans will be capped at $65,000 per student with a $20,000 annual limit. Grad PLUS loans will no longer be available for graduate students after July 2026. Pell Grants will be expanded to include nondegree programs like job training for accredited institutions.

- Health Savings Account contribution limits will be increased and indexed for inflation. More plans will also be eligible for HSA’s.

- New reporting and compliance requirements for digital assets such as cryptocurrencies.

Financial Planning in Light of the OBBB

New tax legislation always highlights the value of incorporating tax planning into the general financial planning processes. Here are some early ideas. Each person’s tax situation will have personally relevant details that can assist with planning ideas and opportunities:

- Review the new legislation to provide clarity of updated potential tax liability. For many, the tax status will be slightly lower than previously anticipated, at least for 2025.

- You’ll need to stay aware of which provisions will sunset and which will stay permanent until new legislation is passed. A financial planner can help with this.

- New deductions are available for senior citizens, people who traditionally receive tip wages, those receiving overtime, and certain car loans. Understanding eligibility and income phaseouts will be critical each year.

- Small business owners should carefully review the legislation with tax professionals and financial planners.

- High net worth individuals (with potential estates in excess of $15-30 million will likely want to review gifting strategies with estate planners, financial planners, and tax professionals.

- With major shifts in the education and funding landscape, resilience in planning for paying for college and early planning are increasingly important. New Trump Accounts will be introduced in 2026 and offer an immediate impact to children born between 2025 and 2028.

- The $500,000 adjusted gross income level becomes critically important for those looking to take advantage of higher state and local tax deductions. Tax planning each year may assist with knowing.

- Charitable giving provides expanded access to tax breaks, but a slight reduction for those that itemize. Careful planning will remain important.

- If you’re looking to take advantage of clean energy credits, the clock is ticking and you’re probably not the only one hurrying to lock in a deal!

- Many financial advisors do not consider taxes in their advice and are not equipped to coordinate with tax professionals or keep an eye on shifting tax dynamics.

At Pearl Planning, we understand that taxes and the ever-changing policy landscape play a central role in shaping your financial future. That’s why we integrate tax-aware strategies into every financial plan we create, staying informed on new laws—like the One Big Beautiful Bill Act—to uncover opportunities and help you avoid costly surprises. Whether you’re a business owner, a high-net-worth individual, a busy family, or planning to retire soon, our team is here to help you navigate these changes with confidence.

Contact us today to discuss how these new provisions may impact you and how we can help you make the most of them.