With the 2024 presidential weeks away, you may be wondering how the election results may impact your finances and money. This quarter’s Pearl Planning investment and economic update webinar focuses on your money and the election. Melissa Joy, CFP®, CDFA® and Lucy Valandra, CFP® share valuable insights on why elections matter for your money.

Here are the key takeaways:

The Need for Certainty

As humans, we naturally crave certainty, especially when it comes to our finances. Your mind naturally wants to predict the future and prepare for what’s coming, even if it’s not your first choice. Inevitably, elections are associated with uncertainty, which can lead to anxiety and knee-jerk reactions. While you can’t predict who will win or how markets will respond, understanding this can help you make more thoughtful, informed choices.

It’s important to remember that while your instincts push you to predict outcomes based on past events, successful investing requires a mindset shift. Rather than focusing on a single possible outcome, it’s wise to build a strategy that prepares for multiple possibilities.

Historical Election Trends and Market Performance

If you were to use history as your guide, staying the course rather than deviating based on an election outcome is the recommended action.

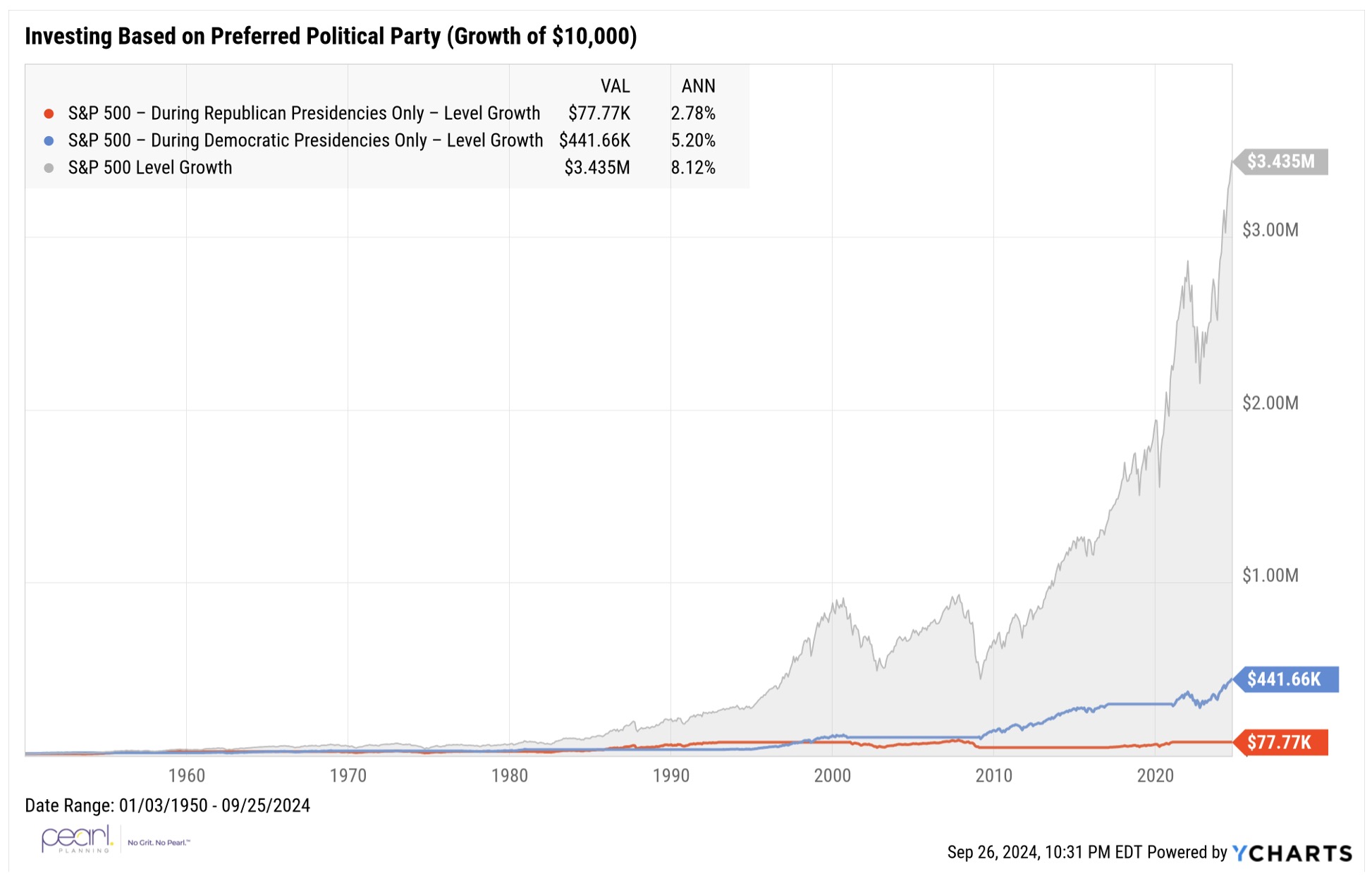

Since the 1950s, regardless of whether a Democrat or Republican is in office, the stock market has delivered an average annual return of about 8%. If you only invested during a Republican or Democratic administration, your returns over the same time period would have been about 3% and 5% respectively. Conventional wisdom or your party preferences might indicate that one party or the other is better for the economy, but history tends to suggest that investment results across parties are worth being a market participant.

Taxes and Policy Shifts

Tax policy is always a major focus during elections, and investors often have questions about how potential changes will impact them. Former President Trump’s Tax Cuts and Jobs Act sunsets in 2025 making it more likely that the new president and congress would need to compromise on some new tax legislation during the first half of the next term.

In the webinar, key areas of focus included:

- Corporate Taxes: It is generally perceived that a Trump presidency will be friendlier toward tax treatment for corporations.

- Personal Income Taxes: It is generally perceived that a Harris administration might result in lower personal income taxes for lower and middle-class Americans, especially with tax credits such as the child tax credit. For high-income-bracket Americans, the potential for higher tax rates is perceived to be more likely with a Harris administration.

- SALT Deductions: Changes to the cap on state and local tax (SALT) deductions could also be in play, depending on the election outcome. The SALT deductions were capped with Trump’s Tax Cuts and Jobs Act, and it is generally considered to be more likely that this limit might be uncapped (and thus favorable to higher earners) under a Harris administration.

It’s crucial to remember that these policies can’t be implemented unilaterally. Congress plays a role, and compromises are often required. Because of this, it’s wise to seek personalized tax advice to navigate any changes, which is something that Pearl Planning focuses on with our clients.

Action Steps for Investors

Here are some key strategies for navigating an election year with confidence:

- Manage Your Mindset: Elections are stressful and that impacts all aspects of your life. When you feel you might need to make adjustments, it can be helpful to discuss with a professional like a financial planner.

- Stay Invested: Avoid making impulsive decisions based on election results. History shows that long-term performance is resilient regardless of which party wins.

- Plan for Tax Impacts: Work with a financial planner to understand how potential tax changes could affect your personal situation.

- Diversify for Uncertainty: The last couple of years have been extraordinarily good return environments for investors. Make sure that your portfolio is diversified and rebalanced to weather a variety of potential election outcomes without taking on too much risk.

At Pearl Planning, we like to say that markets and the economy don’t care who is president. Moreover, most investors’ timeframe is much longer than the US election cycle. With the right guidance and a solid investment strategy, you can successfully navigate election years without letting politics derail your financial goals.

Make sure you’re subscribing to Pearl Planning newsletters to stay on top of relevant news and information through the election and beyond.