This time of year, many of us begin thinking about how we can help the causes closest to our hearts. It is the season of giving after all! When making your plans for charitable giving, there are many ways to ensure that your gifts are made in a way that aligns with both your financial planning and tax strategy. Donor advised funds (DAF) can be a valuable planning tool to give added flexibility and convenience to your giving strategy.

What is a Donor Advised Fund?

A DAF is essentially a charitable investment account. You have the ability to contribute cash or securities to the fund and then distribute the assets to one or more public charities. One of the many benefits of a DAF is that you typically get to take an immediate tax deduction for your contribution, however, you can spread the actual gifts to charities across multiple years if desired. Funds in your DAF also have the added benefit of growing tax-free.

You may be wondering, “why would I want to make a lump-sum contribution to a DAF and then spread the charitable gifts across multiple years”? For most folks, the reason this is an attractive feature is related to maximizing the benefits of itemized deductions.

In recent years, the standard deduction has increased, meaning that there is a higher threshold to qualify for itemized deductions. With a DAF, you can contribute multiple years’ worth of charitable gifts to your DAF and then spread the actual gifting of the assets over the next several years. This allows your charities of choice to receive a steady stream of donations but gives you the advantage of capturing the potential tax saving of itemizing your deductions. This strategy is often referred to as “bunching”.

Is a Donor Advised Fund right for me?

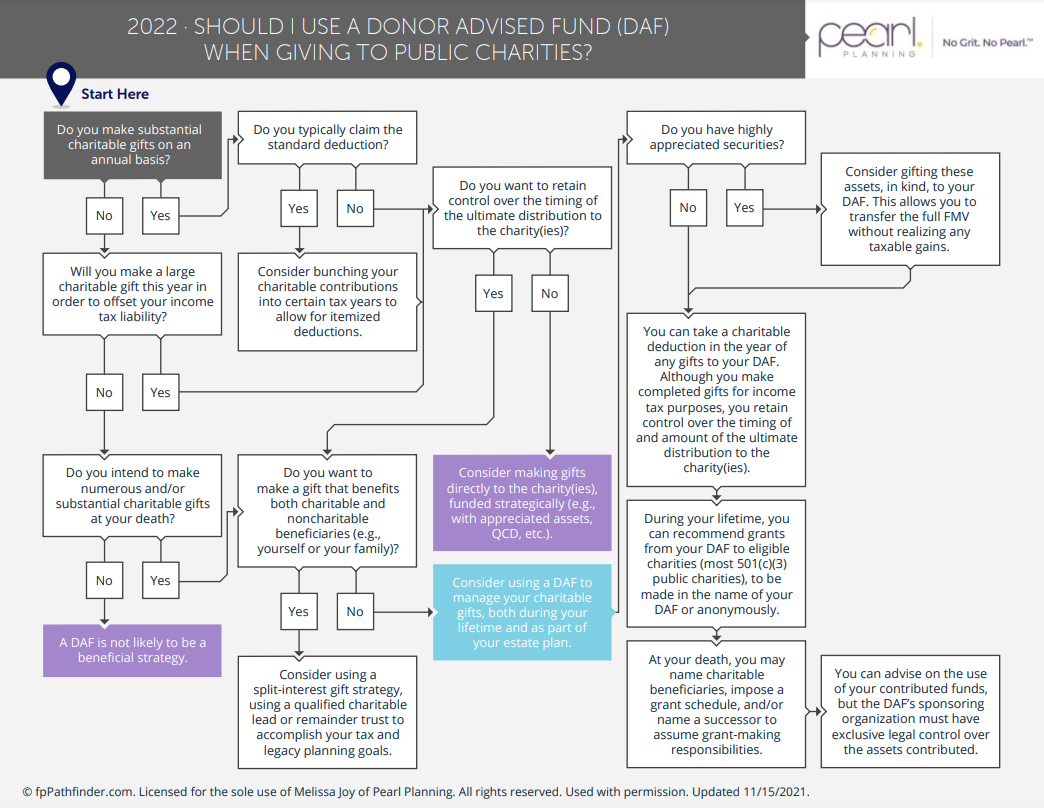

The first question to ask yourself when considering whether a DAF makes sense for you is whether you make substantial charitable gifts on an annual basis. Whether you plan to make a large charitable gift to offset income tax liability or intend to make numerous substantial charitable donations upon passing away, a donor advised fund may be the solution. A DAF can be utilized both during your lifetime and as part of your estate planning strategy.

It is important to note that donor advised funds are typically only suggested for gifting to qualified charities. If you plan to leave assets to individual loved ones, a DAF would not be recommended as the gifting strategy. However, you can use other strategies such as a qualified charitable lead or a remainder trust to achieve legacy planning for both charitable and noncharitable beneficiaries.

What assets should I contribute to my DAF?

If you have a taxable account with securities that have substantially increased in value over time, these assets may be good candidates for contributions to your DAF. Donating highly appreciated securities typically allows you to receive a tax deduction for the full market value of the asset, without having to worry about the embedded gain if you were to sell these securities within your taxable account.

Although assets in a donor advised fund can remain there indefinitely, donations to the DAF are irrevocable. This means that if you donate assets or cash to your DAF, you do not have the ability to change your mind down the road and withdrawal the funds for personal use.

What if I wish for my donation to be anonymous?

Gifts from your DAF can be made to charities in the name of your fund or completely anonymously. This allows you even more flexibility on the distribution of your assets. You can also advise the charity on the recommended use of your contributed funds. However, keep in mind that the DAF’s sponsoring organization must have exclusive legal control over the assets contributed.

Donor advised fund giving strategies can be a powerful tool for making the most of your charitable donations. Many people utilize DAF strategies for:

- Logistical ease of keeping track of contributions online

- Increased flexibility in aligning giving strategy with tax planning strategy

- A way to maximize tax savings by donating highly appreciated assets

- A tax-free growth fund that allows for a higher level of control over gifting approach

Over the years, we have assisted many clients with setting up a donor advised fund to help them accomplish their charitable, financial, and tax planning goals. If you or someone you know may benefit from utilizing a donor advised fund strategy, please reach out to schedule a call today.