President Trump’s “Liberation Day” tariff announcement on Wednesday, March 2nd, sent shockwaves through US and global trading markets for the remainder of the week. I am writing this as of midday April 4th. While sizable tariffs were expected and priced into the market before that day, the magnitude and implications of the tariff announcements were deemed to be significantly more extensive and more pronounced than previously anticipated.

All About Tariffs

For much of my career, tariffs have been a secondary consideration for the economy and markets. Why? Because tariffs have been widely deemed harmful when used broadly, based on past historical experience. Please don’t take that from me; Ronald Reagan explains it best in his own words about what he learned as a child about the harm of tariffs. Alternatively, here’s the Ferris Bueller explanation if you need a refresher on what you might have learned in high school economics.

It is highly unusual for the president or Congress to create policies that are primarily predicted to harm the American economy and American consumers in this way. Full stop. This is not how we’re used to our government operating. Markets and financial experts are attempting to engage with President Trump and his team to advocate for a different approach.

Tariffs are taxes placed on foreign goods. The bill is paid to the taxing government by the importer, and the prices are passed along to the consumer of goods—that’s us. Here’s a great explainer on tariffs. There are some curious rationales in the Liberation Day tariffs:

- While the president called the tariffs reciprocal, the formula used to calculate reciprocity did not involve tariffs. The formula appears to incorporate factors related to trade deficits, currency, and other variables, but exclude calculations of US service exports —a significant and profitable part of our economy. A detailed examination of the factors is provided here.

- The list of tariffs includes unoccupied territories that don’t have human economies. The list seems hasty, to say the least, and Wall Street Journal coverage seems to confirm a chaotic and shoot-first, aim-latter approach.

- What happens after tariffs are imposed? A favored exempt list from the White House is here. Parties will try to parlay favor to get off the list.

- Now comes the counterattacks, tariffs can escalate into “wars” because the counterparty has its options for escalation and retaliation. There are no winners. These are the lessons ingrained in our grandparents’ and great-grandparents’ collective memories that identified Herbert Hoover as an economic villain after almost a century. China’s retaliatory first step was a 34% increase on costs of our exports. They won’t be the only ones to counterattack, and this can result in more bad market reactions.

- Global implications include increased probabilities of ongoing inflation, economic weakness, and recession, as well as currency weakness for the dollar and shifting global alignments among trading partners and power participants.

Does it sound like I don’t like tariffs? You’re right, and I’m not alone. This isn’t a partisan point of view; it’s steeply rooted in economic and market perspectives, and it’s all about your money.

What Happens Now?

So, where do we go from here after I laid out the doom and gloom of tariffs? The markets are speaking to President Trump and his policy makers. Other Washington participants may also shift their alliances. We are already seeing a bipartisan proposal in the Senate modifying executive tariff powers. We can’t predict where we will go next, but we can prepare.

Here are some things that we are keeping in mind and implementing in client portfolios and financial plans:

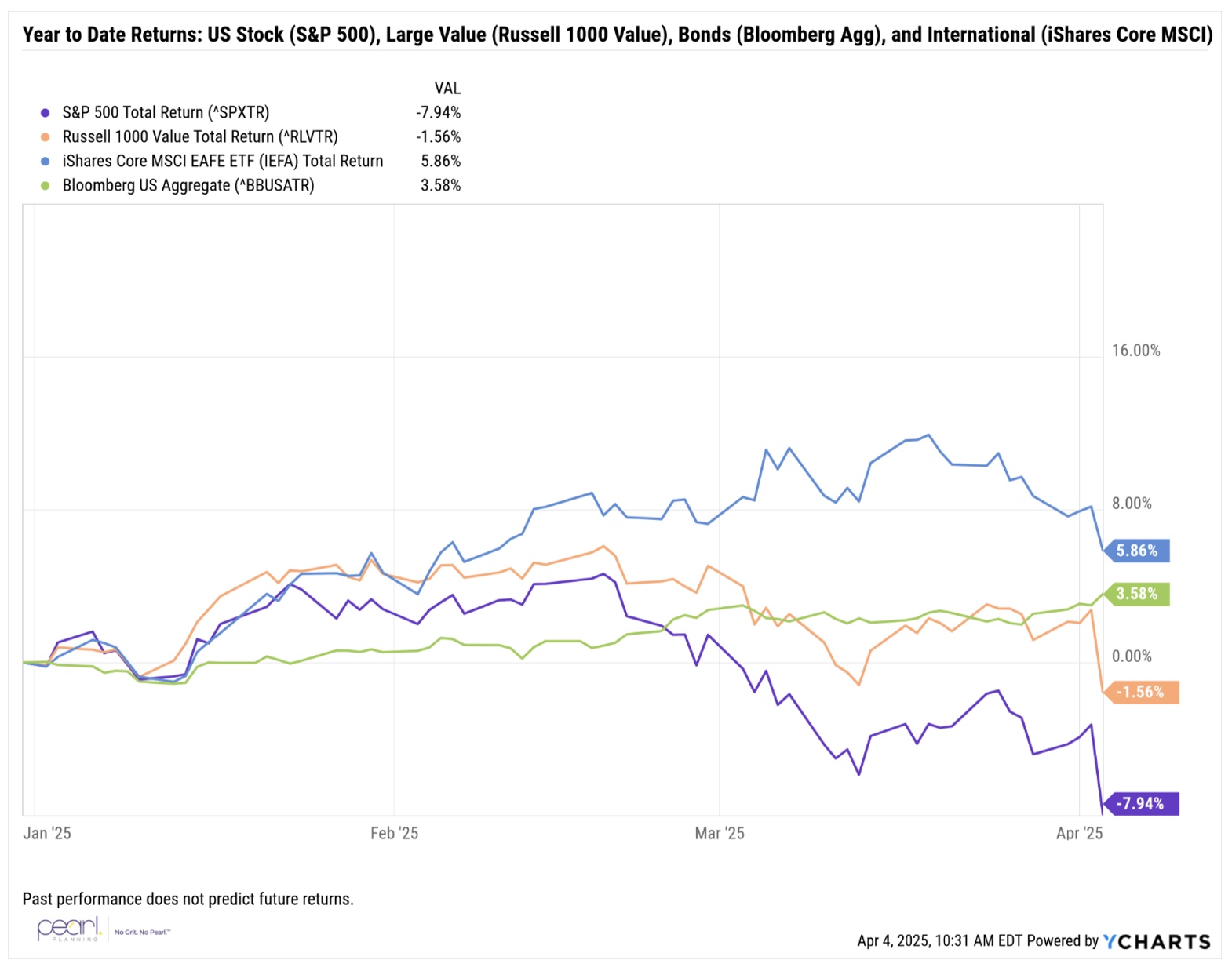

- Diversification continues to work. Bonds have traded higher, primarily due to projected lower rates resulting from economic weaknesses, while stocks have traded lower. Value stocks hold value better than blended and growth stocks. International stocks began the year strong and have continued to outpace US stocks. As shown in the chart above, returns vary depending on the type of investment. Alternative investments and those that can generate returns despite volatility are also beneficial in diversifying portfolios during times like these. We are deploying these types of investments to support our client accounts.

- When markets are down, they also tend to bounce around with higher up days, too. Do not think you can predict what will happen next. Sharp upswings can happen just as quickly as major downswings, and stepping away from investing only means that you may be locking in losses. When things go topsy-turvy with high volatility, it tends to remain as a trend, both up and down, and don’t think you have a crystal ball. No one does.

- Your financial plan is your road map. Having a financial plan means that your money has been organized with risk and rainy days in mind. Your cash is on hand to help you navigate through. Your portfolios are rebalanced to mitigate risk. Your attention to detail in good times builds resilience and flexibility for difficult times. Recognize that your commitment to all aspects of financial planning ensures you are better prepared than you would be otherwise.

- We are here to help. The role of our team at Pearl Planning is to help guide you through difficult times. This is one of the most important and influential aspects of the work we do. I began my career in the late 1990s, which allowed me to learn numerous lessons over the past 27 years. I recall the exhaustion of the COVID-19 crisis in March 2020. I spoke with early retirees in September 2008. I have managed an investment committee throughout the last 20 years. My colleagues, Toni Wander and Alexa Kane, share similar experiences and insights. Our management through this time is informed by our process, our professional lessons, and our commitment to your financial future.

Your instinct right now may be to do something. That’s what our early ancestors needed to do to protect themselves in times of fear. For our clients, you have already taken a step by hiring us to work with you to build a roadmap and game plan for good days and bad. For all-time highs and bull markets, as well as bear markets and recessions. We hate that you are watching this unfold, but we know that our experience and communication can help to guide you.

So, what should you do? Take a breath, take a walk, spend time with your family. Read this, make sure to focus on long-term perspective. Don’t get stuck in a negative loop.

Watch for more communications and insight – we’ll boost our frequency of communications while things stay uncertain. If something is changing in your life or you just want to talk, please let us know by calling the office or sending us an e-mail.

On behalf of everyone at Pearl Planning,

Melissa Joy, CFP®

Founder, Pearl Planning