Incentive Stock Options (ISOs) are a form of equity compensation sometimes offered by an employer. ISOs provide employees a share in the potential appreciation of a company’s value. Often these options have preferential tax treatment. Understanding how your ISOs fit into your cash flow analysis, tax plan and long-term investment strategy can help you make the most informed decisions and maximize the benefits of your ISOs.

Understanding the Ins and Outs of your ISOs

Understanding the specifics of the options granted to you can be a great first step when it comes to your ISOs. If you are looking for more information on your options, check out your employer’s stock plan or your grant agreement which should include details regarding your ISOs.

There are a few key terms to understand relating to your ISOs.

- Grant Date: The date that your ISOs are issued by your employer.

- Vesting Schedule: The period of time or event that must be satisfied before you are allowed to exercise your options (if applicable).

- Exercise Date: The date you have the ability to sell your stock. It is important to note that you do not have to sell your shares on the date the shares are exercised.

- Sale Date: The day that you decide to sell your shares at fair market value.

When researching your ISOs, keep in mind whether you are subject to a vesting schedule. Vesting schedules often include either a specific period in which your options vest or certain performance goals that trigger your vesting rights.

Some ISO plans have early exercise features. Exercising your options prior to vesting can have both advantages and risks depending on your specific financial situation. Early exercise features can also come with more complicated tax planning.

It may also be beneficial to research how the termination of your employment impacts your options. Many times, you have up to three months to make a qualifying disposition of shares upon termination of your employment. (We will discuss the definition of a qualifying distribution in the final section) Also, verify if your plan has any clawback provisions which may allow your employer to take back the options.

Exercising your ISOs

It can be overwhelming to determine when to move forward with exercising your ISOs. The first step to consider is the exercise price of the stock compared to the stock’s current fair market value. It is beneficial to exercise the option when the exercise price is lower than the fair market value. Once the shares are exercised, they can be sold at their current fair market value and a profit would be made. This profit is also known as a bargain element.

Tax implications are another important factor to consider when exercising your ISOs. While there are no tax consequences at the time of exercise, the exercise date starts a timer on which you must make some important decisions regarding when to sell your shares.

Selling your Shares

There are a few details to consider in order to take full advantage of the preferential tax treatment of your ISOs. It is also critical to ensure that the timing of the sale of your shares aligns with your tax planning strategy.

A “qualifying disposition” is a sale of your shares more than two years after the grant date and more than one year after the exercise date. Any gain on the sale receives advantageous long-term capital gains tax treatment on the bargain element. As a reminder, the bargain element is the amount by which the stock price exceeds the exercise price.

If you sell the shares before meeting both of the above holding periods, this is a “disqualifying distribution,” which loses the favored tax treatment of an ISO. Any gains will be subject to a blend of ordinary income tax and capital gains tax. For AMT purposes, you may have a negative AMT adjustment at sale, equal to the excess of the AMT basis over your regular tax basis. If your short-term goal is to meet a pressing need for liquidity or reduce a single-stock concentration, a disqualifying disposition may outweigh the tax benefits of holding the underlying stock.

A few forms that may be helpful to reference when tracking your tax basis, AMT basis, and minimum tax basis are forms W2, 1099, 3921, 6521, and 8801.

ISOs can be a fantastic benefit offered by your employer. Many clients find that ISOs can assist in achieving future financial goals. Integrating your exercise and sale strategy into your overall cash flow, savings, and tax planning strategy can ensure you are making the most of your ISO plan.

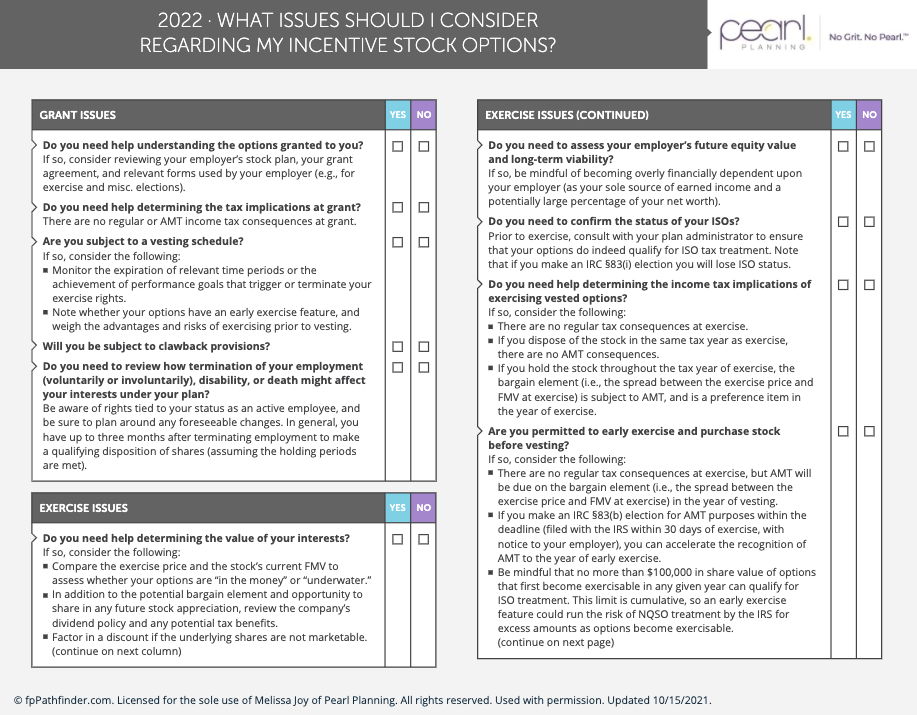

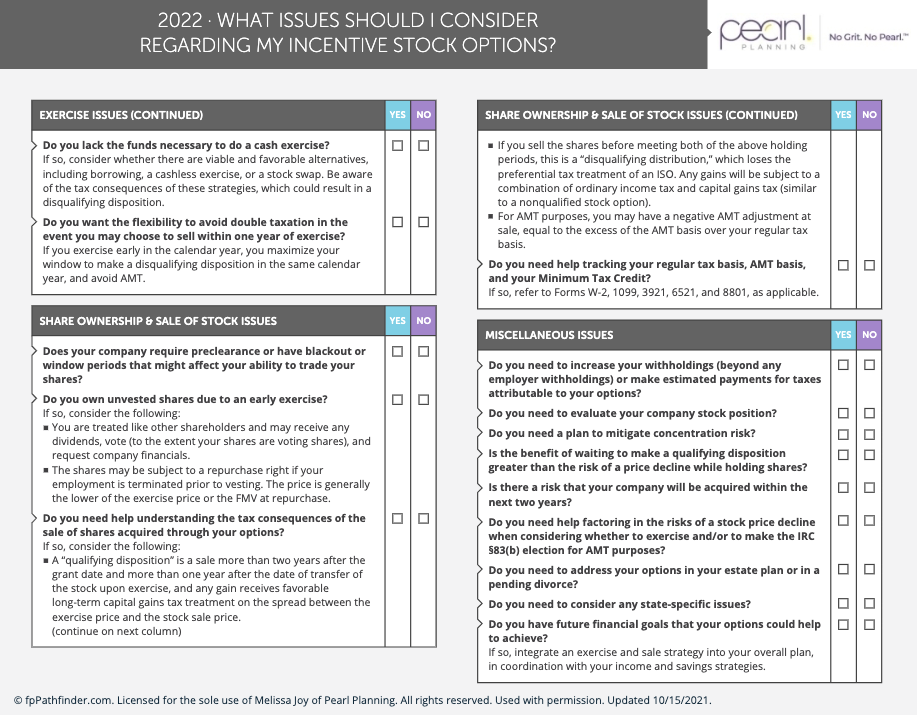

The checklist below is an excellent guide to help you understand your options when it comes to your ISOs. If you would like to discuss how your ISOs fit into your overall financial plan, please feel free to schedule a meeting here.