Employee Stock Purchase Plans (ESPP) allow the purchase of employer stock at a discount. This creates an incentive for employees to increase their ownership stake with the company. There are a few important dates to keep in mind when it comes to your ESPP.

- Option Grant Date: The date that the ESPP is awarded by your employer.

- Offering Period: The period that you can make contributions to your ESPP account.

- Purchase Date: The date that your employer uses the funds in your ESPP account to purchase shares of company stock.

Typically, employees can make contributions to ESPP plans through payroll deductions. These contributions can be made throughout the offering period set by the company. Once the purchase date arrives, the company uses the employee’s fund balance to purchase stock in the company at the agreed upon discounted rate.

When it comes to shares obtained through your ESPP, there are no tax implications until the tax year that you sell your shares. Once you own shares of the company stock, it is important to be mindful of a few specific timelines that must be met in order to optimize your tax planning.

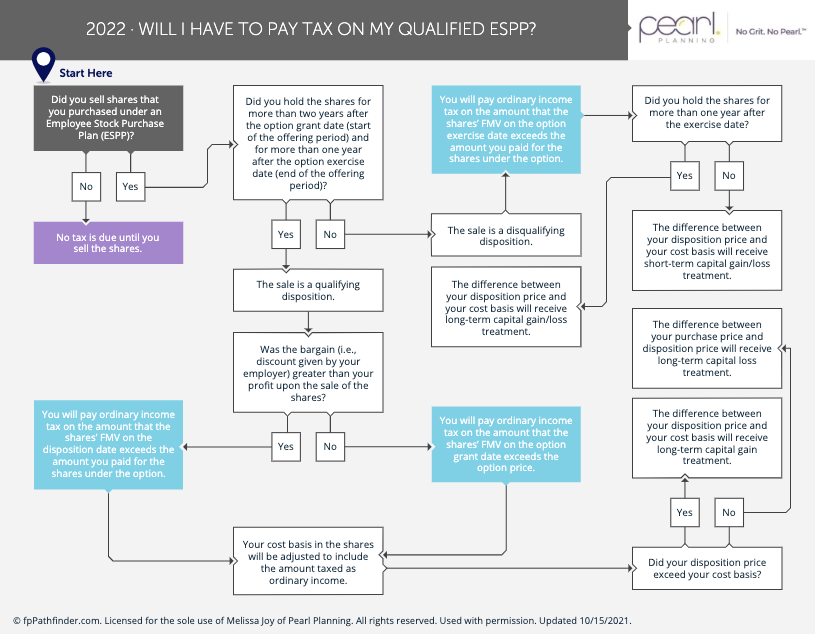

The tax impact upon the sale of shares within an ESPP vary based on how long the shares were held and at what price they were sold. The tax treatment ultimately depends on whether the sale is a qualifying disposition or a disqualifying disposition.

Determine if your Sale is Qualifying or Disqualifying Disposition

If you sold shares purchased under your ESPP during the taxable year, you must determine if you held the shares for more than two years after the option grant date and for more than one year after the option exercise date. In other words, two years after the start of the offering period and more than one year after the end of the offering period.

If these two conditions have been met, the sale is considered a qualifying disposition. If not, the sale is considered a disqualifying disposition.

Factors to Consider with a Qualifying Disposition

Once you have determined that the sale of your shares is considered a qualifying disposition, there are some additional issues to consider for tax purposes. First, you must determine if the bargain discount given by your employer is greater than your profit under the sale of shares. If so, you will pay ordinary income tax on the amount that the share’s fair market value exceeds the amount you paid for the shares under the options on the disposition date.

At this time, your cost basis in the shares will be adjusted to include the amount taxed as ordinary income. If your disposition price exceeds your cost basis, the difference between your disposition price and cost basis will receive long-term capital gain treatment. If not, the difference between your purchase price and disposition price will receive long-term capital loss treatment.

Factors to Consider with a Disqualifying Disposition

If you determine that the sale of your shares is a disqualifying disposition, you have a unique set of tax implications to consider. You will pay ordinary income tax on the amount that the shares’ fair market value exceeds the amount you paid for the shares on the exercise date.

If you held the shares for more than one year after the exercise date, the difference between your disposition price and your cost basis will receive long-term capital gain or loss treatment. If not, the difference between your disposition price and your cost basis will receive short-term capital gain or loss treatment.

The flowchart below addresses the potential tax consequences you may face when participating in your ESPP. The flowchart also helps you map the tax calculations upon the sale of employer stock acquired through your plan based on your specific situation. If you would like to discuss how to make the most of your ESPP as it relates to your overall financial plan, please schedule a meeting here.