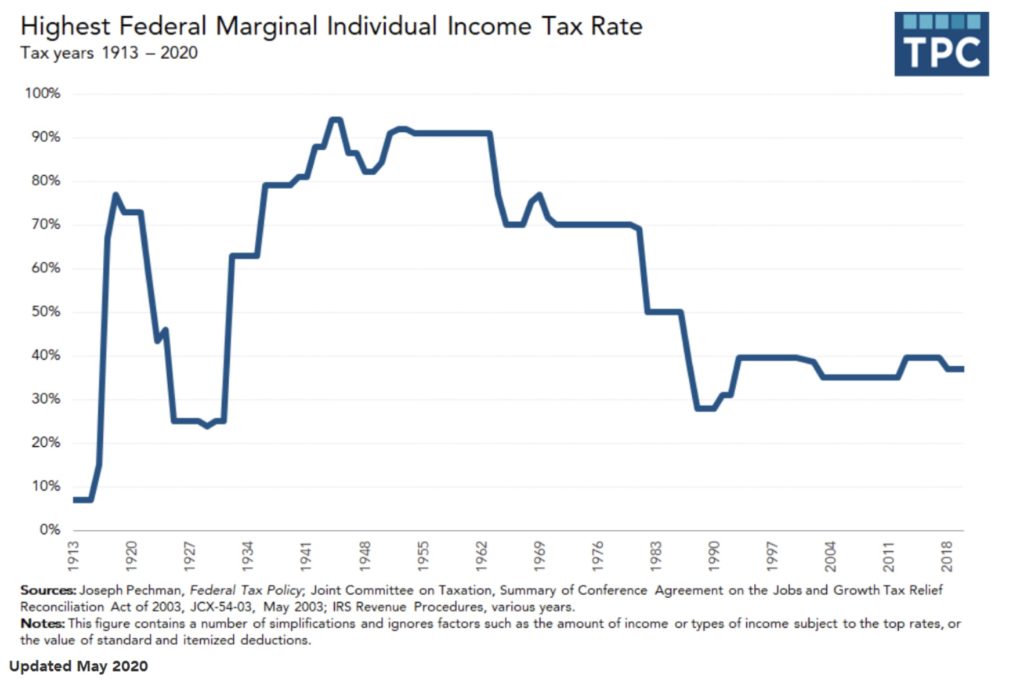

Taxes have changed over time throughout American history. In 2021, many Americans anticipate a higher tax rate with the Biden administration. Current top income tax rates are on the low end of the historic spectrum. How can you prepare and act if you anticipate a higher tax regime? How can an investor prepare and evaluate their options in an uncertain future?

Here are some of the strategies we are discussing with clients. Keep in mind that we are speaking in general terms and not providing specific tax advice. We recommend discussing your options with a tax professional and financial planner if you are planning to make adjustments.

Source: Tax Policy Center

Know Your Current Tax Situation.

While taxes may go higher, the impact of tax changes is typically dependent on your income tax bracket. There are a lot of nuances when it comes to your income taxes. You must consider both your state and federal tax situation. You also need to understand the difference between your marginal tax bracket (the tax rate for the next dollar you earn) and your effective tax rate (the average percent you pay in taxes on all of your income).

To inform yourself of proposed tax changes, make sure you are evaluating the impact based on your personal circumstances Once you understand your current tax rate, evaluate if you have control over tax decisions. It is possible for taxes to go up for one portion of the population while they go down for another group of taxpayers.

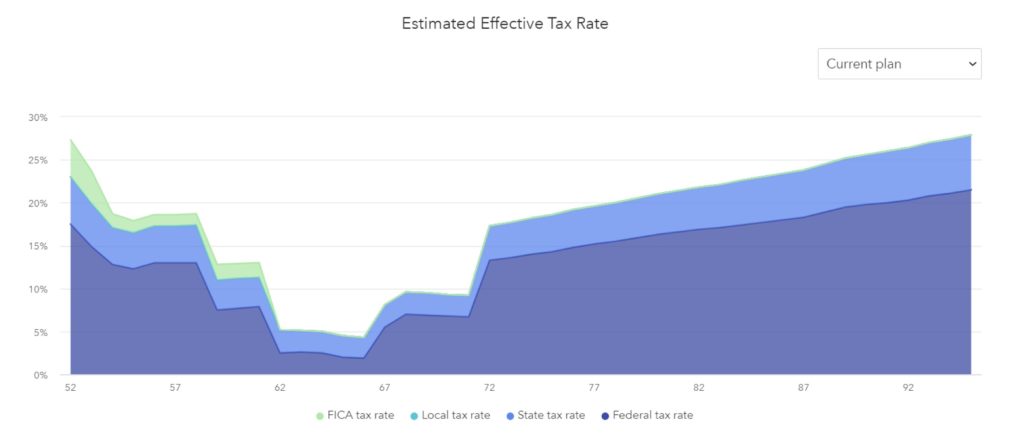

Further, during your lifetime, your tax situation will likely change even if tax laws do not. The chart below shows the theoretical projected future tax map of a worker planning to retire in their fifties. As you can see, even using current tax law (including sunset of Tax Cuts and Jobs Act) would result in variable tax over time due to transition from work to retirement, filing for Social Security income, and enforcement of required minimum distributions.

Source: Right Capital

Traditional vs. Roth Retirement Contributions

If you have access to an employer retirement plan or are self-employed with a retirement plan, you may have an option to choose between traditional tax-deferred contributions vs. Roth tax-exempt contributions.

If your income is high with corollary high tax rates, you may prefer to maximize your savings in traditional routes. This can reduce your current tax obligations. You will want to weigh the current tax break vs. the potential tax-free advantage of a Roth contribution. The right answer for one year may be different in the future, so make sure to evaluate over time.

If you think tax rates will be going higher in the future, you may decide that you prefer Roth contributions now. This might ensure that you have tax-exempt growth and the ability to withdraw from retirement accounts without taxes in the future higher tax environment.

Roth Conversions

Think taxes are going higher in a future tax year? You may choose to pay some of the taxes for traditional retirement assets by converting them into a Roth IRA. The portion converted would be taxed in the current tax year and added to your income. Then, the growth of the assets would be in a tax-exempt investment vehicle.

Roth IRA assets have the advantage of avoiding required distributions that are mandatory for IRA and 401(k) assets. A conversion may both raise your tax-exempt growth and reduce the tax costs of required minimum distributions.

Who might benefit from Roth conversions?

- Early career workers: If you have low current income because you are growing your career or have a gap in employment, evaluate Roth options, but don’t forget that you will need to come up with the money to pay associated taxes.

- Low or No Earned Income: Let’s face it, income can be variable. Perhaps you have a business that receives its income in clumps. Maybe you have a gap in employment. Make sure you are discussing your circumstances with your financial planner BEFORE the end of the year so you can make effective decisions at the right time.

- Young Retirees: We also often discuss Roth conversions with early retirees. If you retire before you take your Social Security and are forced to take required distributions, a Roth conversion may be to your benefit. Keep in mind you will need to come up with funds to pay for your retirement needs as well as the tax bill for the conversion.

- Generational Wealth Transfer: Forward thinking families who anticipate they will be leaving assets to future generations may want to lower the tax burden of an inheritance by paying taxes on retirement accounts now. This might be particularly appealing if the parent generation is in a lower tax bracket than their kids. Additionally, if you think prevailing tax rates will drift northward, there may be an added benefit.

Contribute to Health Savings Accounts

Health savings accounts (HSAs) are newer investment vehicles and they are often misunderstood. People often think that HSAs are just for savings and should stay in cash for immediate medical costs. The beauty of these accounts is that they can also be invested and used for future medical expenses. You get a tax break when you contribute to an HSA as well as withdraw tax-exempt for health costs. Keep in mind that you must have a high-deductible health plan to contribute to an HSA and that you cannot contribute to an HSA when you are on Medicare.

Adjust Investment Portfolios

If you think taxes are going up, you may want to adjust some of the ways that you invest. Here are some strategies you might consider. If you want to learn more, check out our Tax-Aware Investing Webinar from 2019.

- Harvest tax gains: It’s possible that capital gain rates could go higher in future tax changes. If you feel this is imminent, you may want to take capital gains at the current potentially lower rates. Conversely, if you have tax-loss carryforward, you may consider conserving those losses for use in future, higher-tax years.

- Adjust to municipal bonds: If you have bond positions in taxable investment accounts, you may want to evaluate the merits of shifting toward municipal bonds which do not have a federal (and sometimes state) tax on the income the bond generates. Municipal bonds are typically more appropriate if you are in a high tax bracket, so make sure to evaluate the decision to use these assets based on your personal tax bracket.

- Evaluate tax costs with each transaction: When we adjust in client taxable portfolios at Pearl Planning, we consider the tax consequences of changes. Taxes don’t necessarily trump the case for an investment change, but they should be a factor to be considered.

- Make an appropriate cost basis election: You will report your capital gains or losses from investment transactions based on cost basis elections. Investment firms often offer choices for your election decisions which can impact your tax bill.

How Can Your Financial Planner (or Pearl Planning) Help?

A financial planner is a great thinking partner, along with your CPA or tax professional, to help you strategize for managing your taxes over time. Your decisions should always be in context of your personal circumstances and your financial goals. As your life changes, as the world changes, your decisions should be reviewed and updated.

Each year, we review our clients tax situation looking for opportunities and discussing options with our clients based on their stage of life. If you need to analyze your investment-related tax decisions or would like to consider a more tax-effective investment strategies, reach out for a complimentary conversation on how we can help.