August 2019 Investment Update: Muddling Through a Temperamental Market

A record-setting start to the year has been abruptly halted by trade turmoil and an inflection point for bonds and interest rates. What’s going on in the market this month? It’s a normal, or even appropriate, response to feel anxious or concerned when investments pull back. Here are our observations and some recommendations for action.

Trading Tremors

It’s been a long time since trade wars dominated domestic headlines. The US and China continue to posture with tariffs and rhetoric headlining increasingly icy relations. This chill has started to be visible in export and import numbers and seems to be impacting the Chinese economy.

Negative Yields

In Europe, slowing economic numbers have tightened the lid on interest rates in the EU and Switzerland. Negative yields seem to be here to stay in the region. This phenomenon, long believed to be temporary, is now becoming a way of life.

Inverted Curve

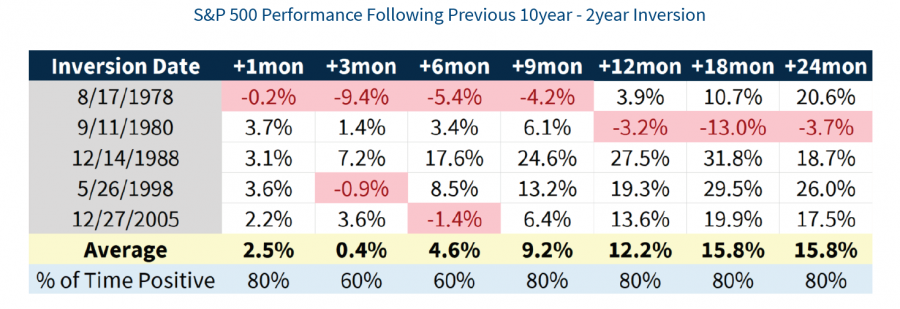

On Wednesday, the US yield curve inverted for the first time in more than a decade. This is when interest rates for 10 year treasuries are lower than those for 2 year treasuries. This yield curve formation has long been believed to be a recession warning. We would note that the lead time for recessions post curve inversion has often been years, not months. Also, previous inversions preceding recession were not at such low interest rates.

Source: Larry Adam, Raymond James, August 14, 2019.

Interestingly, yield inversions have not always forecast immediate market doom. Of course, past performance does not predict future returns. Further, low, super-low, and negative bond interest rates may leave investors looking for opportunities elsewhere in things such as stocks.

For a comprehensive breakdown of the market right now including investment, technical, and economic perspective, visit the Raymond James Investment Committee August 14th update here: https://www.raymondjames.com/-/media/rj/dotcom/files/advisor%20opportunities/totm-%20diversion-inversion-submersion-coercion.pdf.

What do we do now?

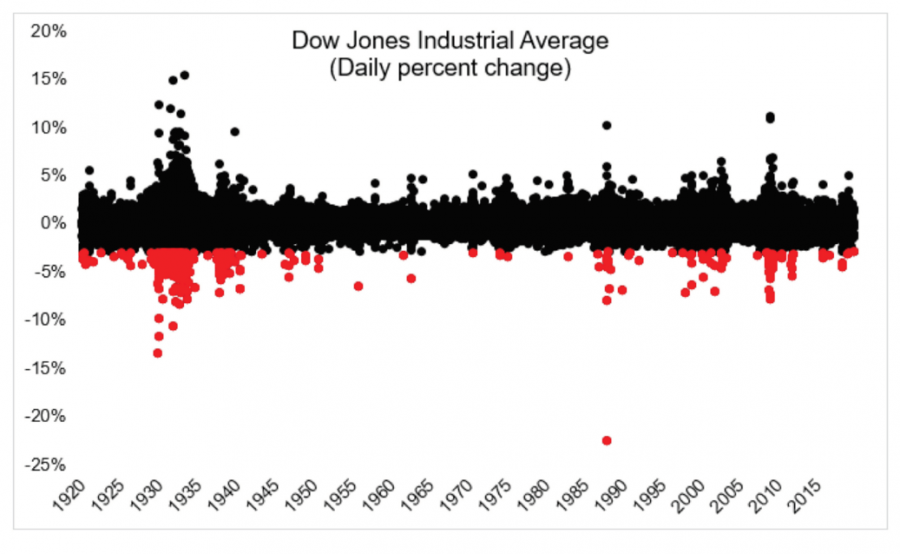

- Put things in perspective. Dow down 800 points has a menacing feel to it, especially if it is written in a massive bold headline! First, convert the giant points to percentages. Then, put those percentages into the context of history. Michael Batnick of Ritholtz Wealth Management noted on Twitter Wednesday that it was the 307th time that the down fell more than 3% in the last 300 years with this accompanying chart.

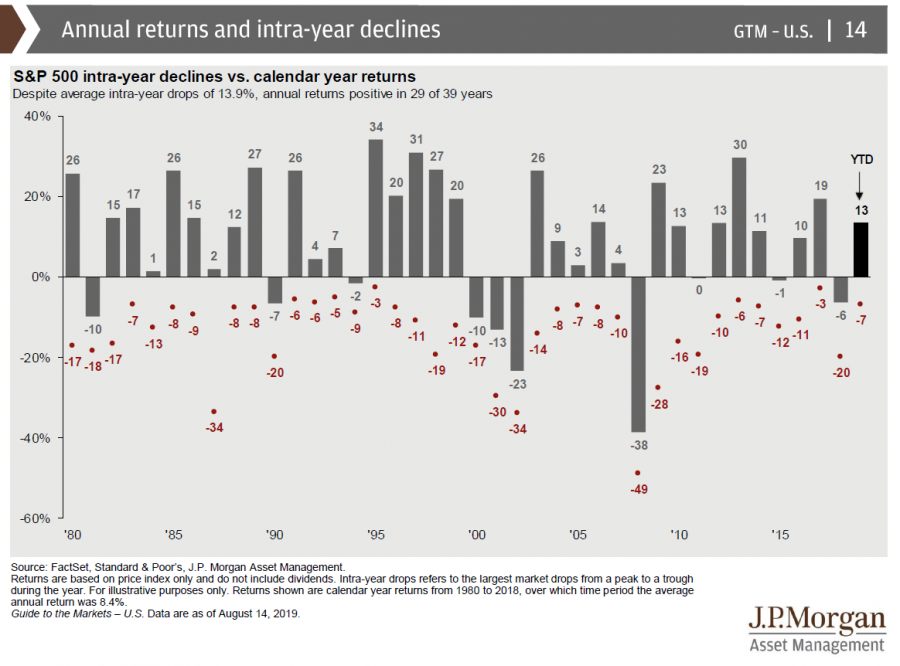

In fact, drawdowns of much greater significance are common in markets. The biggest pullback in the S&P 500 this year has been 7% (as of August 14th), a little more than half of the average intra-year pullback going back to 1980 – see the JP Morgan chart below.

- Take care of yourself. It is natural to feel scared, nervous, anxious when markets go down. Acknowledge your concerns. Talk through them with a financial professional (you can call me if you would like to discuss).

- Revisit your financial plan. If you have a financial plan – I really hope you do and can help if you don’t – it should be built for market volatility. Do you have immediate or short-term cash needs? Have your financial circumstances changed? Then revisit your financial plan. If you revisit your plan and still feel anxious, as you might, continue the discussion with a financial professional.