Market predictions are a way of life for many investment commentators and financial advisors. If you’re looking for the same from me and Pearl Planning, you’ll likely be disappointed. The business of predicting investment returns is fraught with distractions and I feel it may harm rather than assist with your probability for success.

First, kudos to whoever predicted the roller coaster that was the market last year. Even more accolades shall go to the people who knew that cash as measured by Barclay’s 1‐3 month treasury would beat out almost every asset class for top return honors. If a magician existed who could conjure such a forecast, they would deserve your awe. But, their act would be more for show than substance as the difficulty in repeating such prognostication would be incalculably difficult and rare.

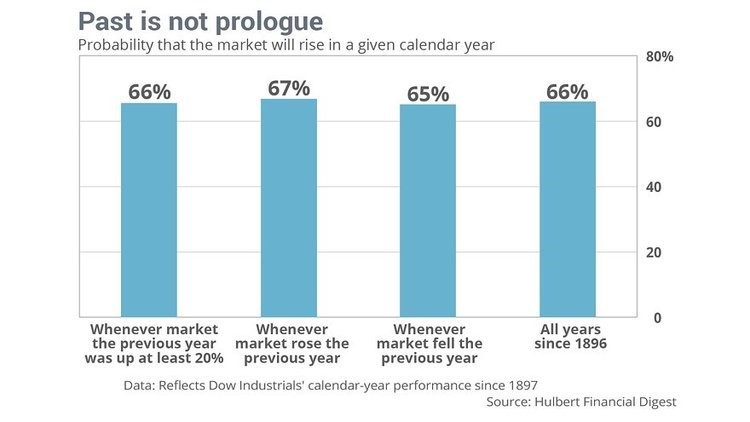

How do you avoid prediction obsession? Consider statistical probabilities as an alternative. You might be surprised that these odds were published a few years ago, but their persistency remains.[1]

And thus, the probability is with you that in more years than not, you will likely receive potential positive returns. Still, there are those unfortunate years about one-third of the time where results are disappointingly negative.

What does one do with the uncertainty of what’s next?

Focus on things you can control, not things out of your hands.

- Your investment behavior and financial decisions may be a potential gold mine. Studies say that the most quantifiable advantage of working with an investment advisor is behavioral coaching which may add 1.5% to investment returns. [2]

- Review your allocation. A commitment to sticking with a consistent allocation can help smooth out the potentially wild ride of investing.

- Don’t give away funds by paying extra taxes or fees. Pay attention to the costs of your investments. Also, make sure that your investment strategy is modernized with appropriate cost basis elections, advisable withdrawal strategies for retirement accounts, and investments fit your current tax bracket.

It may feel disappointing to move away from crystal ball “wisdom” foretelling what returns are next. The inquiring mind wants to know the future. Keep your eye on the prize of financial confidence by focusing on things you can control utilizing probabilities for the rest.

[1]Here are the odds that US stocks will rise in 2016”, Mark Hulbert, Marketwatch, 1/8/2015, https://www.marketwatch.com/story/here-are-the-odds-that-us-stocks-will-rise-in-2016-2015-12-08

[2] “Putting a value on your value: Quantifying Vanguard’s Advisor Alpha, September 2016, Vanguard.